Non Recoverable Draw Against Commission

We may receive compensation from partners and advertisers whose products appear here. Compensation may impact where products are placed on our site, but editorial opinions, scores, and reviews are independent from, and never influenced by, any advertiser or partner.

It's exciting to have a fast-growing business with a product you can sell on your own. But, eventually, you will need to hire a sales team to do the selling for you. When you do that, you'll need to decide how to pay them.

You can pay straight commission, salary with a bonus at the end of the year, or a base salary with some commission. In this article, we'll talk about one way to do payroll for sales people, called draw on commission, that allows you to pay only commission, but also gives them the security of a regular paycheck.

Overview: What is a draw against commission?

Draw against commission is a type of commission plan that guarantees a paycheck to your employees each pay period whether or not they have sales in that period. It is especially valuable for new hires who don't have enough experience to earn a steady paycheck based only on commissions.

How does a draw against commissions work?

Let's consider an example scenario. Marvin Gato works for a private contractor selling luxury catios. For the uninitiated, a catio is a patio custom made for cats to explore the outdoors safely.

Catios can get pretty expensive, and Marvin typically earns between $3,000 and $5,000 per month in commissions. His company pays him a draw against commission of $1,000 per week.

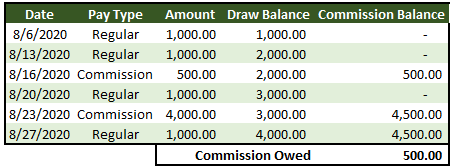

At the end of the month, if he has earned enough commission to pay back the $1,000 per week, the rest is paid out to him. If he has not, the draw balance increases going into the next month. The following graphic shows a typical month for Marvin.

Marvin earned $4,500 in commission money which surpassed the $4,000 he took in draws during the month.

Marvin made two sales during the month. The first was to an older woman, and he discounted the price and only made $500. But the second blew the doors off (literally, for that job the contractor must remove the back door) and he is due $4,000 for it.

The $4,500 total commission for the month exceeds the $4,000 in commission draws that he took so Marvin will receive a commission check during the normal payroll process for $500.

If Marvin hadn't secured the second sale, he would go into September with a $3,500 draw balance and have to dig himself out of the hole. Some salespeople can never dig out of the hole. If that's the case with your business, you may consider non-recoverable draws, which we will talk about next.

Types of draws

There are two types of draws against commission: recoverable and non-recoverable. We'll discuss the differences between the two here.

1. Recoverable draw

A recoverable draw is owed back to you by the employee if they do not earn enough in commissions to cover the draw. In the second scenario above, had Marvin continued to flounder and after six months owed a whopping $10,000 to the company, the company would issue a note to him for that amount.

To do a recoverable draw, pick a time frame after which you will issue the note to your employees to inform them of the debt. Keep them updated on their progress and work with them. It can be bad for your reputation to have a lot of employees who owe the business thousands of dollars.

Some businesses will waive recoverable draw debt if employees leave for a different job. This isn't required, but it would build goodwill with employees.

2. Non-recoverable draw

Non-recoverable draws are still paid out of commission, but, if the employee does not earn enough in commissions to pay back the draw, there is no additional debt.

This concept generally works well for new employees who need the security of a regular paycheck while they're building up centers of influence (COIs) and for times of economic recession where salespeople could not make any sales.

Benefits and disadvantages of the draw against commission

There are several pros and cons to consider when thinking about instituting a draw against commission plan:

Advantages of the draw against commission

- Consistent paychecks: This may seem like a benefit only for the employee, but it is also helpful for the business to make more consistent payouts and not have to find $5,000 laying around every time there's a big sale.

- Less stress: Overstressed employees do not perform well. They can be unfocused, unruly, and eventually, they get desperate. A consistent paycheck goes a long way toward lowering that stress.

- Lower overall commissions: There is a tradeoff for the employee: if you offer consistent paychecks, you can offer lower overall commissions. If you have the cash position to make payroll draw payments, you may save money.

Disadvantages of the draw against commission

- Less stress: There is a downside to employees not being as stressed about pay: they may now work as hard to sell. Find a good balance where they are not satisfied with the normal paycheck but they aren't ripping their hair out and guzzling anti-anxiety drugs either.

- Conniving employees: Some employees want to just take advantage of you. They will simply do the minimum either to pay back the draw, or if it's a non-recoverable draw, to keep their job. Do regular sales meetings and track everyone's progress. For employees who are lagging, be prepared to cut ties.

- Potentially more turnover: One way that companies can reduce turnover among sales staff is with potentially big commissions that the sales people need to wait for. They spend months on a deal and, by the time the commission is paid out, there is a new massive project that will have its own high commission. If employees know those big commissions will just go to pay down past draws, they could be more likely to jump ship to somewhere that they don't have draw debt built up.

- Tracking: The more information you have to keep track of for payroll, the harder it is. However, as long as you have a good commission-based payroll software or payroll service provider, you should be able to do draws against commission if you stay organized.

Pay commissions or draw 25

Determining how to pay salespeople is complicated. You need to find that balance between incentivizing pursuit of new sales and just putting in the hours. Draws against commissions is a great way to achieve balance by paying commission while still paying consistently each pay period.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

Non Recoverable Draw Against Commission

Source: https://www.fool.com/the-blueprint/payroll/draws-against-commissions/

Posted by: williamsalannow.blogspot.com

0 Response to "Non Recoverable Draw Against Commission"

Post a Comment